Public radio stations are continuing their long trend of revenue growth and public television stations are also growing again after a period of contraction brought on by the Great Recession. However, success is not equally distributed. On average, larger public radio and television stations are growing at much higher rates than their small station counterparts. These are the key takeaways from the latest Annual Financial Report (AFR) data from CPB.

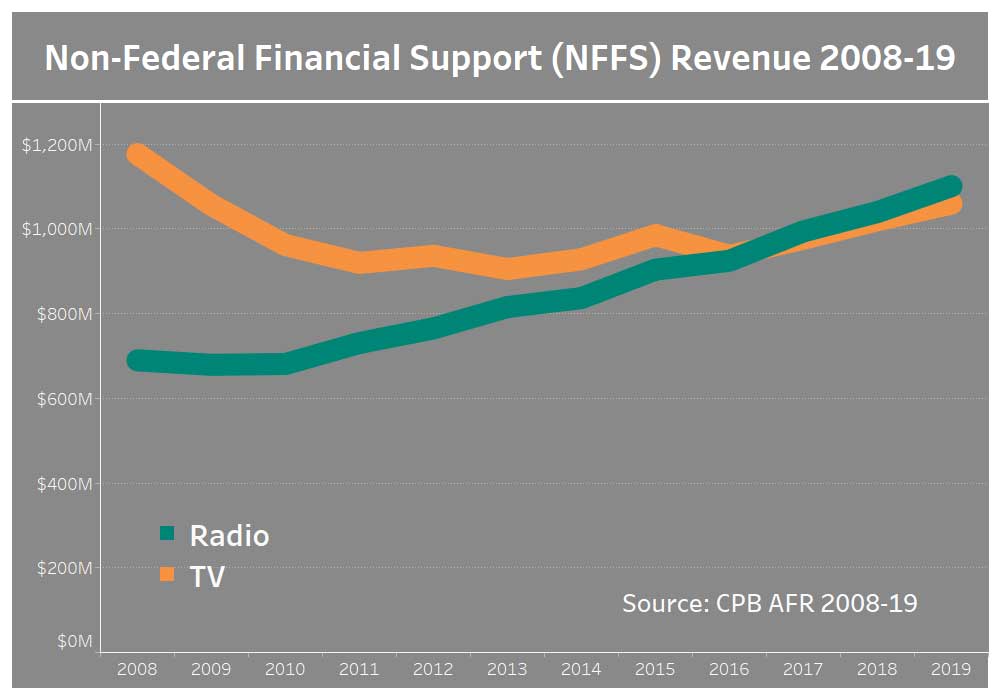

What happened in 2019: Public radio continued its decade-long trend of revenue growth, with Non-Federal Financial Support (NFFS) for public radio stations up nearly 6% between 2018 and 2019 to $1.1 billion. This follows a pattern of year-over-year increases since the Great Recession. Public radio station revenues are now 60% higher than they were in 2008. Public television NFFS in 2019 reached $1.06 billion, up 4% from 2018. However, public television stations have yet to fully recover from the damage of the recession. Public television station revenues in 2019 are still 10% lower than in 2008.

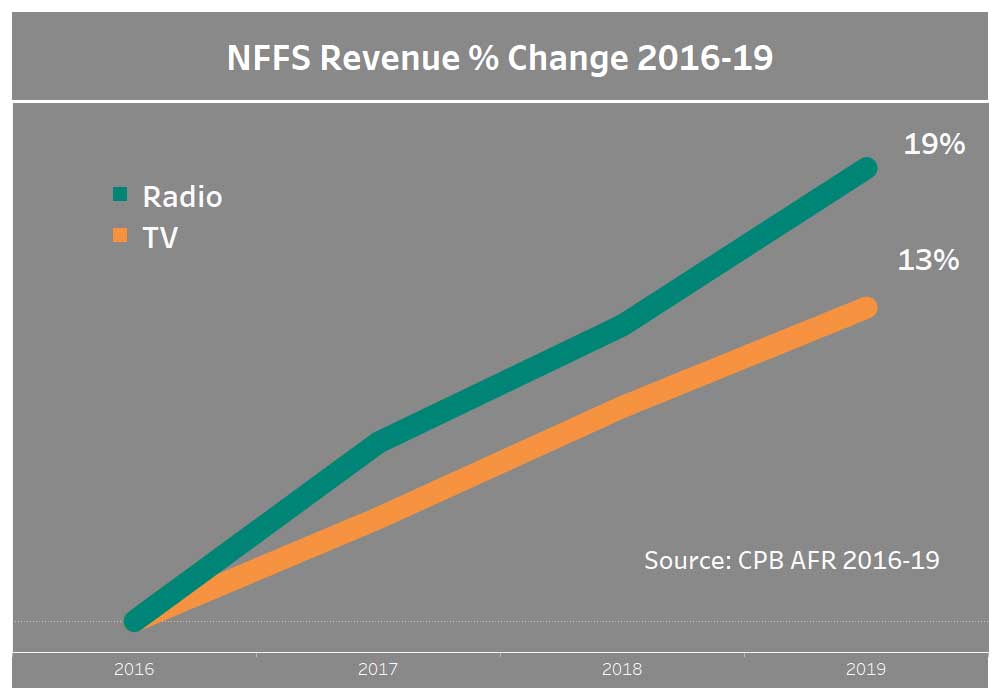

Be smart: Although public television revenue is still below 2008 levels, public radio and television stations have followed broadly similar revenue trends in recent years. Public radio station NFFS grew by 19% from 2016 to 2019 and public television revenue grew by 13%. The past three years marks a period of solid growth for public television after revenue declines during and after the recession and a period of below inflation growth from 2011 to 2016.

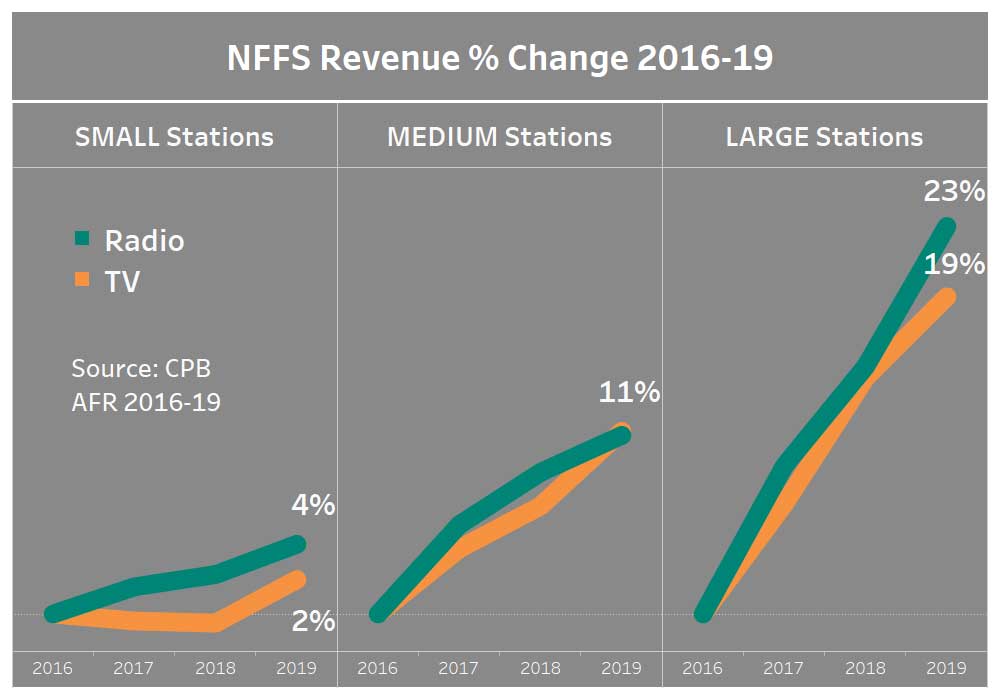

What to watch: Unfortunately, public media’s recent revenue gains are not equally spread across stations. Following a long-term trend, the largest public media stations have grown significantly in recent years but the smallest stations have been unable to grow at the same rate. The largest third of stations grew their NFFS by approximately 20% between 2016 and 2019 whereas the smallest third grew by just 3%. These size-based growth discrepancies are consistent across both public radio and public television.

Yes, but: This analysis uses the most recent AFR data available (2019); however, the data and charts don’t include any impact from COVID-19. It will be another year before we see the impact of the pandemic showing up in the AFR data.

Want more insight: Public Media Company collects, analyzes, and interprets a lot of public media data every day. We provide a variety of insights to help you better understand your organization and identify potential opportunities for growth, including the recently launched station Financial Analysis report. See a sample report and contact Steve Holmes for more information.